Economics

How the Informal Economy Shapes South Sudan’s Future Africa’s | A New Directions For Africa | Docume

South Sudan is the world's youngest nation. Despite its rich cultural diversity and natural resources, the country faces immense challenges, including economic instability and governance issues exacerbated by continuing conflicts. The informal sector, a lifeline for many South Sudanese, plays a critical role in sustaining the nation's fragile economy.Hidden Strength unveils the stories of resilience within the informal economy of Juba. Through expert interviews and local business owners, the film demonstrates how honest livelihoods can be forged even in the face of seemingly insurmountable challenges.Subscribe to our channel: http://bit.ly/AJSubscribeFollow us on X: https://x.com/ajenglishFind us on Facebook: https://www.facebook.com/aljazeeraCheck our website: https://www.aljazeera.comCheck out our Instagram page: https://www.instagram.com/aljazeeraenglishDownload AJE Mobile App: https://aje.io/AJEMobile#southsudan #africasnewdirections #sudan #economy #juba #documentary #africa #informaleconomy

Title: How to Start a Multi-Million Dollar Farm in Ghana – Video Replay

Short Description:

Unlock the secrets to building a thriving agricultural business in Ghana with Calvin Daniels, CEO of Shai Hills Snails and Agriculture Farm Ltd. Learn how he transitioned from a U.S. federal career to running a multi-million-dollar farm, and discover actionable insights on Moringa cultivation, snail farming, and the vast opportunities for Black investors and entrepreneurs in Ghana’s agribusiness sector.

Full Description:

Curious about how to launch a profitable farm in Ghana? This exclusive video replay features Calvin Daniels, a visionary entrepreneur who turned his passion for agriculture into a booming business. From large-scale Moringa farming to high-yield snail production, his journey is packed with valuable lessons for anyone looking to establish a sustainable and lucrative agribusiness in Africa.

🔹 Key Takeaways:

✅ Steps to start and scale a farm in Ghana

✅ Best crops and livestock for high-profit returns

✅ Funding, investment, and business strategy insights

✅ Government policies and incentives for agriculture

✅ Mistakes to avoid and success strategies for entrepreneurs

📅 Event Date: March 2, 2025

⏳ Duration: 1 Hour, 38 Minutes, 36 Seconds

🎥 Instant Access – Watch Anytime!

Take the first step toward your own successful farm in Ghana. Get this video replay today!

Sponsored by https://www.repatriatetoghana.com

Cocoa prices are hitting historic highs, as Western commodities markets are registering deficits of 478,000 tons of cocoa beans.

This is the result of a strategy by West African countries Ghana and Ivory Coast, the two biggest suppliers of cocoa to global markets. Beginning in 2019, they partnered with Chinese firms to process their cocoa in-country, and to sell their product directly to Chinese companies.

By cutting out speculators and traders in Western brokerages, and going around marketing and branding companies in the US and Switzerland, producers in Africa and their buyers in China keep far larger profits for themselves. West African suppliers more than double their exports by grinding their cocoa beans in-country, and Chinese firms realize far higher margins and a guaranteed supply of the world's high-quality processed cocoas.

Resources and links:

Substack, for video transcript and direct links

https://kdwalmsley.substack.co....m/p/now-its-chocolat

Swiss Info, Can China help African cocoa producers outmanoeuvre Big Chocolate?

https://www.swissinfo.ch/eng/b....usiness/can-china-he

China’s Chocolate Market – Trends and Industry Overview

https://www.china-briefing.com..../news/chinas-chocola

CNBC, Cocoa prices climb to new record high, prompting fresh warnings about extreme volatility

https://www.cnbc.com/2024/12/1....7/cocoa-prices-rally

Chart, 2024 coco prices

https://www.instagram.com/navi....amarkets/p/DECxW-OhJ

The chocolate price spike: what’s happening to global cocoa production?

https://www.sustainabilitybynu....mbers.com/p/cocoa-pr

ING, Tightness lingers in the cocoa and coffee market

https://think.ing.com/articles..../tightness-lingers-i

Closing scene, Mount Wuyi River, Fujian province

American officials are passing new regulations intended to drive Chinese companies out of our pharmaceutical supply chains. And drug companies seem to concur, as they say publicly that they, too, need to diversify away from China.

The reality is the opposite. US and European drugmakers make giant profits from the drugs that are manufactured in China, then licensed for sale in the American market. Their motivation is the enormous price difference, between what patients pay in the United States, compared to the rest of the world.

Resources and links:

Substack, for video transcript and direct links

https://open.substack.com/pub/....kdwalmsley/p/trumps-

Novo’s Wegovy Launched in China at a Fraction of US Price

https://www.biospace.com/drug-....delivery/novos-wegov

Bloomberg, Novo Nordisk Launches Wegovy in China With Prices Below US

https://www.bloomberg.com/news..../articles/2024-11-18

Fortune, Novo Nordisk launches Wegovy in China with prices well below U.S.

https://fortune.com/2024/11/18..../novo-nordisk-launch

China's Rising Role On The Global Stage In The Oncology Market

https://www.outsourcedpharma.c....om/doc/china-s-risin

Toripalimab Becomes First Immunotherapy Drug Approved for Nasopharyngeal Cancer

https://www.cancer.gov/news-ev....ents/cancer-currents

The US is relying more on China for pharmaceuticals — and vice versa

https://www.atlanticcouncil.or....g/blogs/econographic

Major Life Sciences Licensing Deal Trends in China in 2023

https://www.goodwinlaw.com/en/....insights/publication

Wall Street Journal, U.S. Drugmakers Are Breaking Up With Their Chinese Supply-Chain Partners

https://www.wsj.com/health/pha....rma/china-manufactur

Reuters, Merck signs up to $3.3 billion cancer drug deal with China-based LaNova

https://www.reuters.com/busine....ss/healthcare-pharma

Merck licenses Chinese cancer drug, searching for next Keytruda blockbuster

https://www.statnews.com/2024/....11/14/merck-keytruda

PBS, How Russian oil is reaching the U.S. market through a loophole in the embargo

https://www.pbs.org/newshour/s....how/how-russian-oil-

CBS News/60 Minutes, Russia works around international sanctions designed to cripple the economy amid war with Ukraine

https://www.cbsnews.com/news/r....ussia-works-around-i

Politico, Grappling with supply chain crunch

https://www.politico.com/newsl....etters/politico-puls

A Bilateral Approach to Address Vulnerability in the Pharmaceutical Supply Chain

https://www.csis.org/analysis/....bilateral-approach-a

Closing scene, Blue Moon Valley, Lijiang, Yunnan

Welcome back to ABIBITUMI TV, your trusted source for unfiltered news and analysis on African affairs.

I'm your host, and today we are discussing the powerful movement that is rising in Africa’s Sahel region. Young leaders like Captain Ibrahim Traore of Burkina Faso, Colonel Assimi Goïta of Mali, and General Omar Tchiani of Niger are leading an economic revolution to reclaim their countries’ natural resources from decades of foreign exploitation. These leaders are challenging multinational corporations, revoking mining rights, and forming new alliances to benefit their people.In this video, we dive into the bold steps being taken to end neocolonial exploitation, from arresting corporate executives to renegotiating mining royalties and creating a united front against foreign interference. This is a story of resilience, unity, and the fight for true African sovereignty.Do you believe this is the beginning of an African economic revolution? Watch now to explore this historic transformation and join the conversation. Don’t forget to like, share, and subscribe for more insights on Africa’s journey to independence.

Huawei is China's largest electronics company, and is specifically targeted by Western sanctions. The sanctions are intended to both deny Huawei access to the fastest semiconductors, and to prevent Huawei from selling products in American and European markets.

While most of the recent headlines involving Huawei relate to their introduction of smartphones that were thought to be impossible for them, Huawei is first and foremost a telecommunications hardware company. And recent developments in those market segments have only strengthened Huawei across the world.

Perhaps most ironically of all, Huawei has benefited from being locked out of the North American telecommunications market, as the United States has seen major declines in investment and upgrades.

Huawei is far ahead of global rivals in the telecom space, and is doubling down on its efforts to roll out 5.5G technology across the Global South countries. As the company does so, it is a boon to thousands of other Chinese manufacturers, and producers of electronics and other gear that runs on Huawei networks.

Resources and links:

China’s Huawei pushes network gear upgrades in friendly nations, touting AI boost

https://www.scmp.com/tech/big-....tech/article/3285281

Huawei is back – net profits more than doubled in 2023

https://techblog.comsoc.org/20....24/03/30/huawei-is-b

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

https://techblog.comsoc.org/20....24/03/13/delloro-202

Bloomberg, US Efforts to Contain Xi’s Push for Tech Supremacy Are Faltering

https://www.bloomberg.com/grap....hics/2024-us-china-c

Huawei Announces 2024 H1 Business Results

https://www.huawei.com/en/news..../2024/8/h1-business-

Reuters, U.S. bans new Huawei, ZTE equipment sales, citing national security risk

https://www.reuters.com/busine....ss/media-telecom/us-

How economic statecraft shaped Huawei’s global FDI footprint

https://www.hinrichfoundation.....com/research/wp/trad

Closing scene, Karst Limestone Formations, Guilin, Guangxi

Welcome back to ABIBITUMI TV, your trusted source for unfiltered news and analysis on African affairs.

I'm your host, and today we are exploring the incredible story of Ibrahim Traore, the leader who saved 3,000 jobs by reviving the sugar industry! From the brink of collapse to a beacon of hope, discover how Traore's vision and determination brought new life to this critical sector. Get ready to be inspired by this remarkable tale of leadership and economic revival!

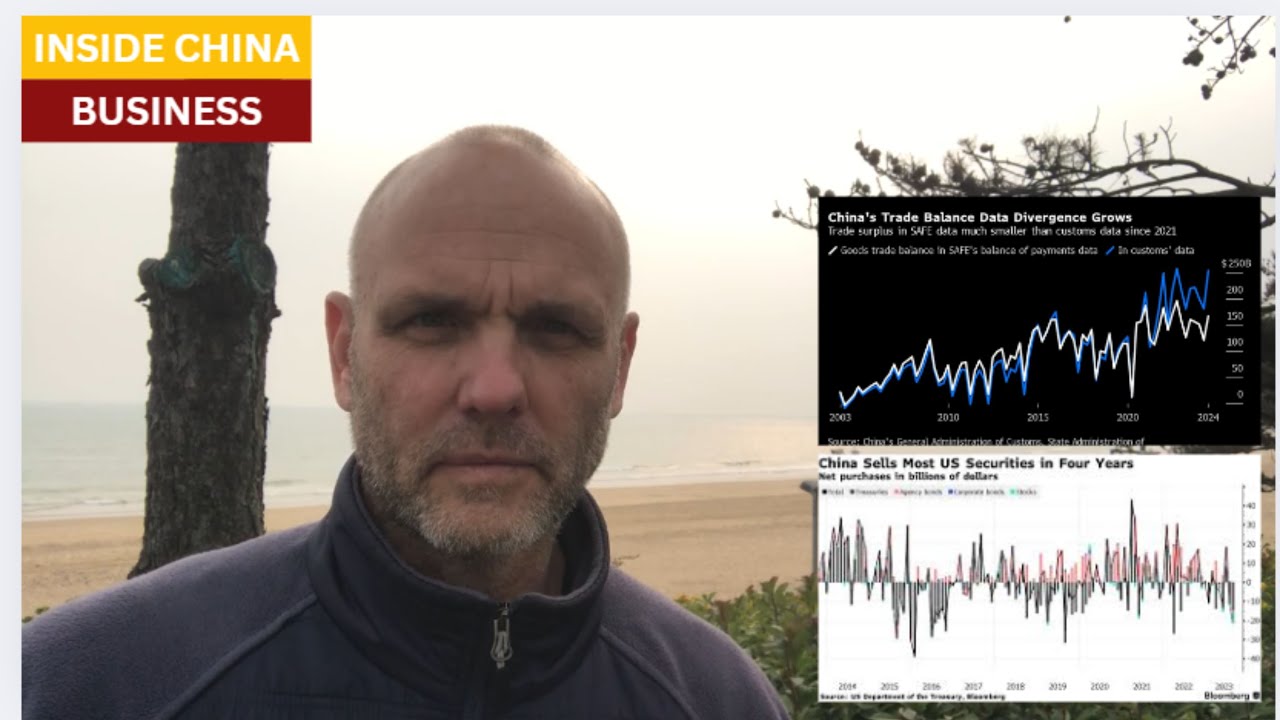

China runs large trade surpluses with the United States. Typically these funds would be returned to the US as capital investments, either through buys of fixed assets, securities, or lending.

China, however, is liquidating stakes in companies in the United States, and is selling off its portfolio of Treasury bonds.

These two trends are resulting in enormous imbalances in Balance of Payments, which much be re-balanced via China's central banking activities. China is clearly recycling giant capital pools from the United States for investment purposes inside China, and among China's top trading partners.

And because the US dollars are never returned to the capital markets, it is also clear that China and the BRICS countries are setting up their own trading and economic bloc, funded largely with US debt instruments.

(Editor note: At about the 2:00 mark, I misspoke. The US ran a trade deficit of approximately $800 billion, not surplus. Apologies.)

Resources and links:

Bloomberg, US Trade Deficit Widens to $78.8 Billion, Largest in Two Years

https://www.bloomberg.com/news..../articles/2024-09-04

Why is China dumping US Treasuries for gold?

https://x.com/SputnikInt/statu....s/178313812393054619

Vanishing Act: The Shrinking Footprint of Chinese Companies in the US

https://rhg.com/research/vanis....hing-act-the-shrinki

China Should Explain ‘Enormous’ Data Gaps, US Ex-Official Says

https://www.bnnbloomberg.ca/in....vesting/2024/09/06/c

Bloomberg, China Plans to Sell Dollar Bonds in Saudi Arabia as Ties Deepen

https://www.bloomberg.com/news..../articles/2024-11-05

The Economist, Chinese firms are growing rapidly in the global south

https://www.economist.com/brie....fing/2024/08/01/chin

Closing scene, Yangzhou Gardens, Jiangsu

Welcome back to ABIBITUMI TV, your trusted source for unfiltered news and analysis on African affairs.

I'm your host, and today we're diving into the shocking news is spreading like wildfire! The CEO of a billion-dollar gold mining company has been arrested in Mali, leaving the entire world stunned. What led to this unexpected move? Was it a result of corruption, embezzlement, or something even more sinister? In this video, we dive into the details of this unprecedented event and explore the implications it may have on the global gold mining industry. Stay tuned for more!

Herbal Results Exciting Investment Opportunity. Find out more here: herbalresults.net/investors