- General Videos

- Music

- Economics

- Health

- Travel & Events

- History

- Psychology

- Spirituality

- Movies

- News & Politics

- Kmtyw Combat Sciences

- Ɔbenfo Ọbádélé Kambon Videos

- Ɔbenfoɔ Kamau Kambon: Black Liberation Philosophy

- Science, Tech, Engineering and Math

- Permaculture

- Self-Sustainability

- Living Off Grid

- Yoruba Language Learning

- Education

- Mmɔfra Adesua

- Nana Kamau Kambon Playlist

- Livestream

- Komplementarity Kouples and Revolutionary Singles

- Abibitumi Film Series

- Decade of Our Repatriation

- Live

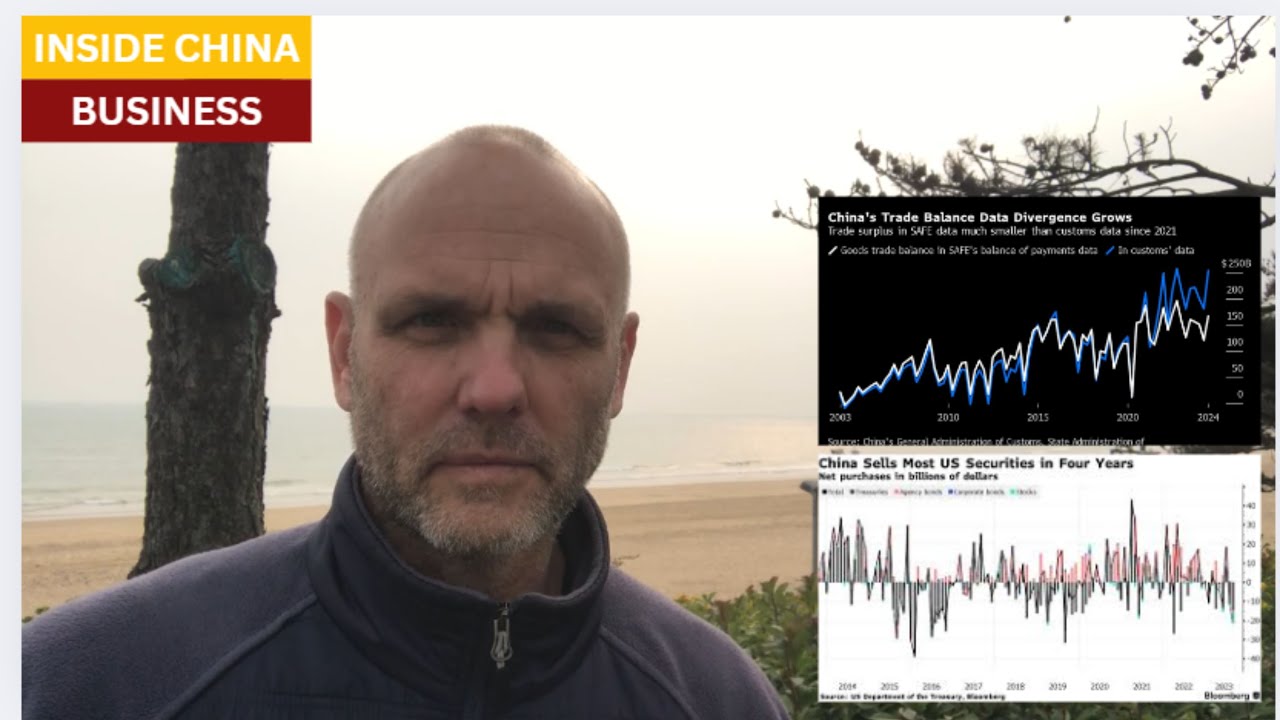

De-dollarization accelerates as China's RMB soars past Euro, Yen; China builds new financial sy

Worldwide adoption of China's currency, the renminbi (RMB), is gaining steam as the de-dollarization push takes hold across the non-G7 countries.

Two macro factors are accelerating the growth of the RMB in place of the US dollar as the preferred currency for trading and settlements. The economic sanctions against Russia, which froze and then seized billions of dollars of Russian USD reserves held in custody in Western banks, are forcing countries and companies to de-risk by moving their reserves from SWIFT-associated financial institutions. Another crucial factor is the high US interest rates, which are sucking in hundreds of billions of dollars from global accounts to feed huge and growing fiscal deficits.

High US government borrowing causes USD to be drained from the global system. Ironically, this causes USD to gain in value outside the US, while feeding inflation and reducing the dollar's strength inside the country.

Simply by moving its USD and Euro reserves from US and European banks to Chinese-based institutions, Chinese banks enjoy the best of all worlds: they receive billions of USD and Euro every day through trading surpluses, and can then lend those foreign currencies and create assets and economic activity on their own balance sheets. Analysis of Chinese banking and lending data confirm explosive growth in Chinese lending abroad, in both RMB and USD.

Resources and links:

Inside China Business, China isn't dumping dollars. They're dumping banks, and setting up a new financial system.

https://www.youtube.com/watch?v=DnzuR-kog-w

National Debt of the United States

https://en.wikipedia.org/wiki/....National_debt_of_the

SCMP, Global use of China’s yuan up sharply, beating pound and yen on internationalisation index

https://www.scmp.com/economy/e....conomic-indicators/a

The renminbi overtakes the euro as a trade settlement currency as its use in global trade finance accelerates

https://asiahouse.org/research...._posts/the-renminbi-

Bloomberg, The Yuan Is Finally Showing Some Muscle in International Trade

https://www.bloomberg.com/opin....ion/articles/2023-12

Third time lucky? China’s push to internationalise the renminbi

tps://www.bruegel.org/policy-brief/t....hird-time-lucky-chin

Closing scene, Guilin, Guangxi province

The United States as a superpower is on its last leg. The fall of the United States as a superpower will not happen in our lifetime, maybe not in our children lifetime. It will happen during our children’s children lifetime.

But,

Whether you like it or not, the United States as a superpower hegemony is coming to an end and it’s coming to an abrupt end fast.

How are we as Black men, as Afrikan men positioning ourselves so that our children children children are in a position to capitalize on the opportunities of China’s rise as the next superpower of the world.

How can we use China to industrialize Kmt=Abibiman=Farafina=the Lands of Black people.

This is not an endorsement of China, This is to show the mindset of a people who wants to build and be a superpower and those who are content and wants to be consumers at the bottom of the totem pole.